Whatsapp Number

0850 252 22 22WALLET SOLUTIONS

WALLETIZE YOUR NETWORK TO MONETIZE IT!

We believe any company can offer financial services. Step in to the new world where the favorite coffee brand can easily become a fintech power…

STEP INTO FINTECH WORLD WITH A WALLET

GET A WALLET OR IT IS

TOO LATE TO REGRET!

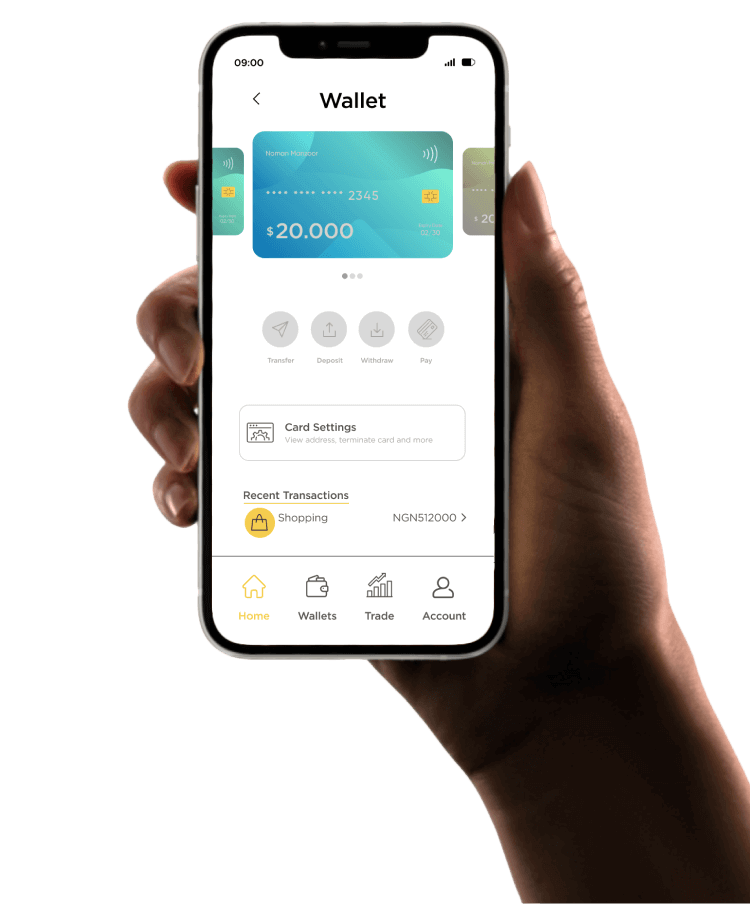

- Offer your customers individual or business wallet accounts.

- Add, top-up, hold or transfer funds between wallets and bank accounts.

- Issue virtual or physical prepaid cards.

- Enrich your application with value-added financial products like credit, investments, insurance etc.

Take your consumer loan experience to another level with our Buy Now Pay Later solution.

Offer Buy Now Pay Later to your customers and boost your sales.

Offer cashback campaigns from famous brands easily.

THE SUPERPOWERS

UPLOADED AUTOMATICALLY

E-Money License

Use e-money license without any technical and operational investment and become compliant with regulations.

Build Your Own Fintech Brand

With our feature-rich API’s, build your own wallet application for your unique business model.

Issue Your Card Program

Design your own prepaid card program and let us issue it for you.

Don’t Worry We Got This!

Don’t worry about building different teams to cover compliance, legal issues, fraud cases, tech team and all. With our expert teams, we will get you covered.

Let Us Guide You

We will help and guide you with our global know-how from the very beginning of your project. After your wallets and/or prepaid cards go live, our operation and product teams will be supporting you. You will never walk alone through your journey.

ANY

QUESTIONS

SHOOT.

- Digital wallets are becoming increasingly popular among consumers, and many businesses are looking to offer this service to stay competitive in the market. While any business can technically offer a digital wallet service, there are certain types of companies that are particularly well-positioned to do so. - These include large and medium-sized companies, subscription-based distribution companies, sports clubs, retailers, and mobile applications that serve individual or corporate customers. In addition, electric vehicle charging station businesses, fuel sellers, automotive companies, financial companies, and fintech companies can all benefit from offering a digital wallet service to their customers. - Overall, any business that wants to stay competitive in the market and provide a seamless payment experience to customers should consider offering a digital wallet service.

- The digital wallet is a game-changer for businesses, and turning your mobile application into a digital wallet can give you a significant competitive edge in the market. Digital wallets can enhance customer engagement and experience, providing a fast and convenient payment method that customers love. - With a digital wallet, you can monetize your customer base by offering personalized rewards, cashback campaigns, and other incentives that keep customers coming back for more. Digital wallets can also increase conversion rates with a "refund to wallet" option for online purchases, making it easy and hassle-free for customers to get their money back. - Another major advantage of digital wallets is the ability to mitigate security risks associated with traditional payment methods, protecting both your business and your customers from fraud and other security threats. - Finally, digital wallets can minimize transaction costs for your customers, making it more affordable and convenient for them to make purchases. By transforming your mobile application into a digital wallet, you can tap into these benefits and stay ahead of the competition in today's rapidly evolving marketplace.

- At our company, we believe in tailor-made solutions that fit the unique needs of our clients. Our 400+ API set is not only feature-packed and comprehensive but extremely flexible and adaptable. We are constantly innovating and adding new features to our API set, and we are always open to further development requests from our clients. Whether it's a minor tweak or a major customization, we work closely with our clients to understand their specific needs and deliver solutions that exceed their expectations. After all, why settle for off-the-shelf solutions when you can have a bespoke API set tailored to your exact requirements.

- Digital wallet services are subject to strict regulatory requirements, and it's crucial that companies offering these services are licensed and regularly audited by relevant authorities. In Turkey, for example, organizations providing digital wallet services must be licensed as electronic money institutions by the Central Bank of the Republic of Turkey under Law No. 6493. - These licensed institutions are considered financial institutions and are responsible for complying with all applicable regulations, including those related to anti-money laundering and fraud prevention. They are also regularly audited by the Central Bank and the Financial Crimes Investigation Board to ensure compliance with these regulations. - As a licensed organization providing digital wallet services, United Payment is legally responsible for ensuring compliance with all regulatory requirements and providing a secure and reliable service to users. By adhering to these regulations, they can maintain the trust of their customers and continue to operate in a competitive and evolving market.

- When integrating applications with digital wallet services, having a robust test environment and developer portal is crucial. Fortunately, our platform offers both. - Our test environment allows developers to explore our feature-rich APIs in a sandbox environment, experiment with our APIs, and test their integration with their applications without impacting production data. This ensures a smoother development process and reduces the risk of errors and downtime when deploying the application to production. - In addition, our developer portal is a one-stop shop for developers looking to integrate their applications. It offers comprehensive documentation, sample code, and other resources to help developers get up and running quickly. Our documentation is well-written and easy to follow, making it easy for developers of all skill levels to integrate their applications with our platform. - Overall, providing a robust test environment and developer portal is just one of the many ways we strive to make it easy and convenient for developers to integrate with our digital wallet service. By providing the tools and resources they need, we're helping to drive innovation and growth in the digital wallet space.